Deposit online and earn 1.75% p.a. With minimum deposit of S$50,001 in 24-month Maybank iSAVvy Time Deposit. The next best alternative to DBS is usually a Maybank fixed deposit. For January, you can earn 1 per cent p.a. With Maybank’s Singapore Dollar Time Deposit. Unfortunately you have to leave it in.

Yes, your money in Maybank Fixed Deposit account is protected by PIDM for up to RM250,000. Read more Fixed Deposit » Maybank. Select from All banks I would like to deposit over. Versa - Affin Hwang Asset Management Interest Rate 2.4% p.a. Early Withdrawal Yes Interest Earned RM600. Public Bank PB Golden 50 PLUS FD Account Interest Rate. ^ Excluding a min. Deposit of $2,000 into a Maybank account. Every $1,000 deposited into Maybank savings accounts will allow a deposit of $10,000 into Maybank Singapore Dollar Dollar Time Deposit account (Until May 2020) Enjoy 1.45% p.a. On 12 months SGD Time Deposit with a minimum placement of $20,000 in a Maybank Singapore Dollar Time Deposit account and a minimum deposit of $2,000 into a Maybank Passbook Savings, Privilege Plus Savings or Maybank. Place an iSAVvy Time Deposit online and earn up to 1.15% p.a. Enjoy 0.90% p.a. On 12-month or 1.15% p.a. On 24-month iSAVvy Time Deposit when you place your deposit online or via Maybank2u SG app!

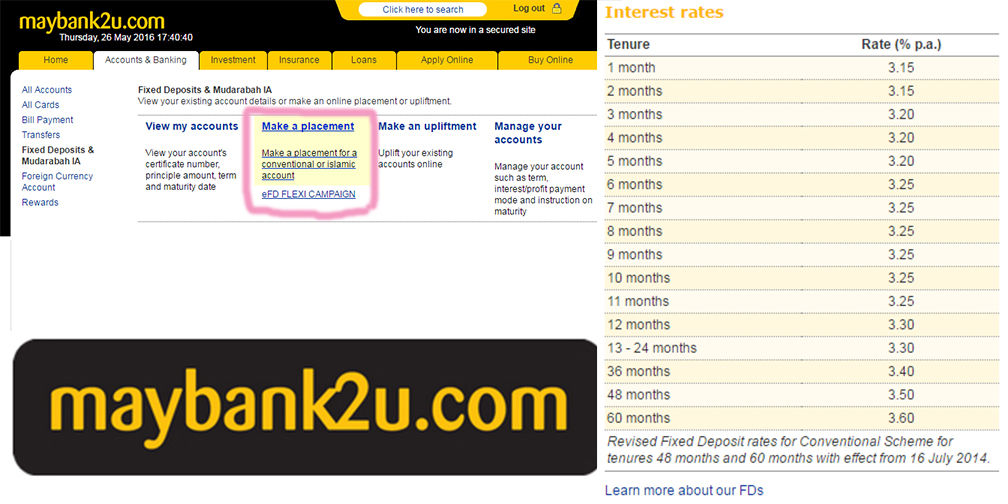

Maybank Fixed Deposit Interest Rate, Maybank Fixed Deposit is a facility that comes with a wide range of tenures and convenient modes of a transaction and allows you to earn returns on your deposit amount through competitive rates.

Maybank Fixed Deposit Interest Rates

The interest rates associated with the Maybank Fixed Deposit are mentioned in the table below:

| Tenure (in Months) | Interest Rate (% p.a.) |

|---|---|

| 1 | 3.15 |

| 2 | 3.15 |

| 3 | 3.20 |

| 4 | 3.20 |

| 5 | 3.20 |

| 6 | 3.30 |

| 7 | 3.30 |

| 8 | 3.30 |

| 9 | 3.30 |

| 10 | 3.30 |

| 11 | 3.30 |

| 12-24 | 3.35 |

| 36 | 3.40 |

| 48 | 3.50 |

| 60 | 3.60 |

Types of Maybank FD

Maybank Fixed Deposit Interest Rate

The following are the 2 types of Maybank Fixed Deposit available for customers:

- Fixed Deposit Account: This PIDM (Perbadanan Insurans Deposit Malaysia) protected account provides you with an interest on an agreed rate on the total deposit amount. With higher rates of interest and flexible tenure range, the facility helps you grow your savings.

- eFixed Deposit: Coming with a convenience of transactions and control via Maybank2u, this package provides a higher rate of interest on deposits with flexible tenures and eligibility of protection under PIDM.

Features and Benefits

The features and benefits associated with Maybank Fixed Deposit are as follows:

- The Maybank Fixed Deposit comes with a higher interest rate than that of a normal savings account.

- The facility is eligible for protection by PIDM.

- The Maybank Fixed Deposit facility comes with a range of tenures that is extendable to 60 months.

- The facility comes with a minimum investment of RM5,000 for one month and RM1,000 for a tenure of 2 months or more.

Eligibility Criteria

- Minimum age requirement: Customers applying for the Maybank Fixed Deposit must be at least 18 years at the time of application.

- Who can apply:

- For Fixed Deposit Account: Any customer applying individually or customers applying on a joint basis are eligible for Fixed Deposit Account.

- For eFixed Deposit: Individuals with Maybank conventional/Islamic account, applicants applying on a joint basis, and sole proprietors are eligible to apply for the Maybank Fixed Deposit – eFixed Deposit.

Maybank Fixed Deposit Promotions 2019

Maybank Privilege, Maybank Private, and Maybank Premier customers can get the benefits of Chinese New Year FD Campaign when the minimum sum is placed in a Conventional Fixed Deposit account. A Maybank Privilege customer can get a promotional rate of 4.00% p.a. when a minimum sum of RM100,000 is deposited in fresh funds. The deposit must be maintained for a period of 6 months. The campaign also allows you to deposit rollover funds. You can get a promotional rate of 3.90% p.a. on rollover funds.

If you are a Maybank Private or Maybank Premier account holder, you have to make a minimum deposit of RM250,000. The deposit must be maintained for 12 months to get the promotional benefits. You can get a promotional rate of 4.28% p.a. if the deposit is made using fresh funds. On the other hand, you will get a rate of 4.18% p.a. if rollover funds are used.

The promotion is valid from 2 January 2019 until 28 February 2019.

| Participating Product | Account Type | Minimum Deposit Amount | FD Tenure | Promotional Rate for Fresh Funds | Promotional Rate for Rollover Funds |

|---|---|---|---|---|---|

| Conventional FD | Maybank Privilege | RM100,000 | 6 months | 4.00% p.a. | 4.28% p.a. |

| Maybank Private and Maybank Premier | RM250,000 | 12 months | 3.90% p.a. | 4.18% p.a. |

How to open Maybank Fixed Deposit

You can contact the bank with the request of Maybank Fixed Deposit via its customer service numbers. You can also visit the nearest Maybank branch in order to apply for the Maybank Fixed Deposit.

Maybank Contact Number for Fixed Deposit

You can call the customer service and hotline numbers of Maybank: 1-300 88 6688 and 603-7844 3696 (overseas) for further information regarding Maybank Fixed Deposit.

FAQs

Q. Can I make a premature withdrawal with Maybank Fixed Deposit?

A. You are allowed to make a premature withdrawal with your Fixed Deposit Account, but the same is not allowed for eFixed Deposit.

Q. What is the minimum range of tenures with Maybank Fixed Deposit?

A. The tenures available with Maybank Fixed Deposit range from 1 month to 60 months.

Q. Can I open a Maybank Fixed Deposit with my spouse on a joint basis?

A. Yes, you can open a Maybank Fixed Deposit on a joint basis.

Q. How is the interest calculated with eFixed Deposit scheme?

Maybank Fixed Deposit Rate History

A. The interest under eFixed Deposit is calculated on a daily basis.

Q. What if I fully withdraw the amount before the maturity with a 2-month Maybank Fixed Deposit?

A. The bank shall not give any interest on the amount with tenures of 1 to 3 months if the facility doesn’t reach its maturity.

Get the savings account that best suits your needs.

Convenience of round-the-clock online banking.

Requirements

Minimum Initial deposit of S$500 (Singaporeans/PR/Malaysian with WP)/ S$1,000(Foreigners)

S$2 (Singaporeans/PR)/ S$5 (Foreigners) monthly fee if average balance is below S$1,000

Earn up to 3% interest p.a. and enjoy a higher base interest.

Requirements

Minimum initial deposit of S$500 (Singaporeans/PR)

Enjoy complimentary insurance and birthday privileges with this passbook savings account made just for children and teens under 16 years old.

Earn attractive monthly interest, with bonus interest of 1.56% p.a.

Requirements

Minimum opening deposit of S$500

S$2 monthly fee if average balance is below S$500

Enjoy attractive interest rates and free personal accident insurance coverage, exclusively for our privileged customers aged 50 and above.

Requirements

Minimum initial deposit of S$500 (Singaporeans/PR)/ S$1,000(Foreigners)

S$2 (Singaporeans/PR)/ S$5 (Foreigners) monthly fee if average balance is below S$1,000

Attractive interest of up to 0.35% p.a.